Canadian Oil Industry Insights: Opportunities for Traders

Canada's oil industry plays a pivotal role in the global energy market, offering unique opportunities for traders looking to create a reliable income source. This in-depth analysis explores the current state of the Canadian oil sector, its impact on international markets, and how savvy traders can capitalize on this resource-rich nation's potential.

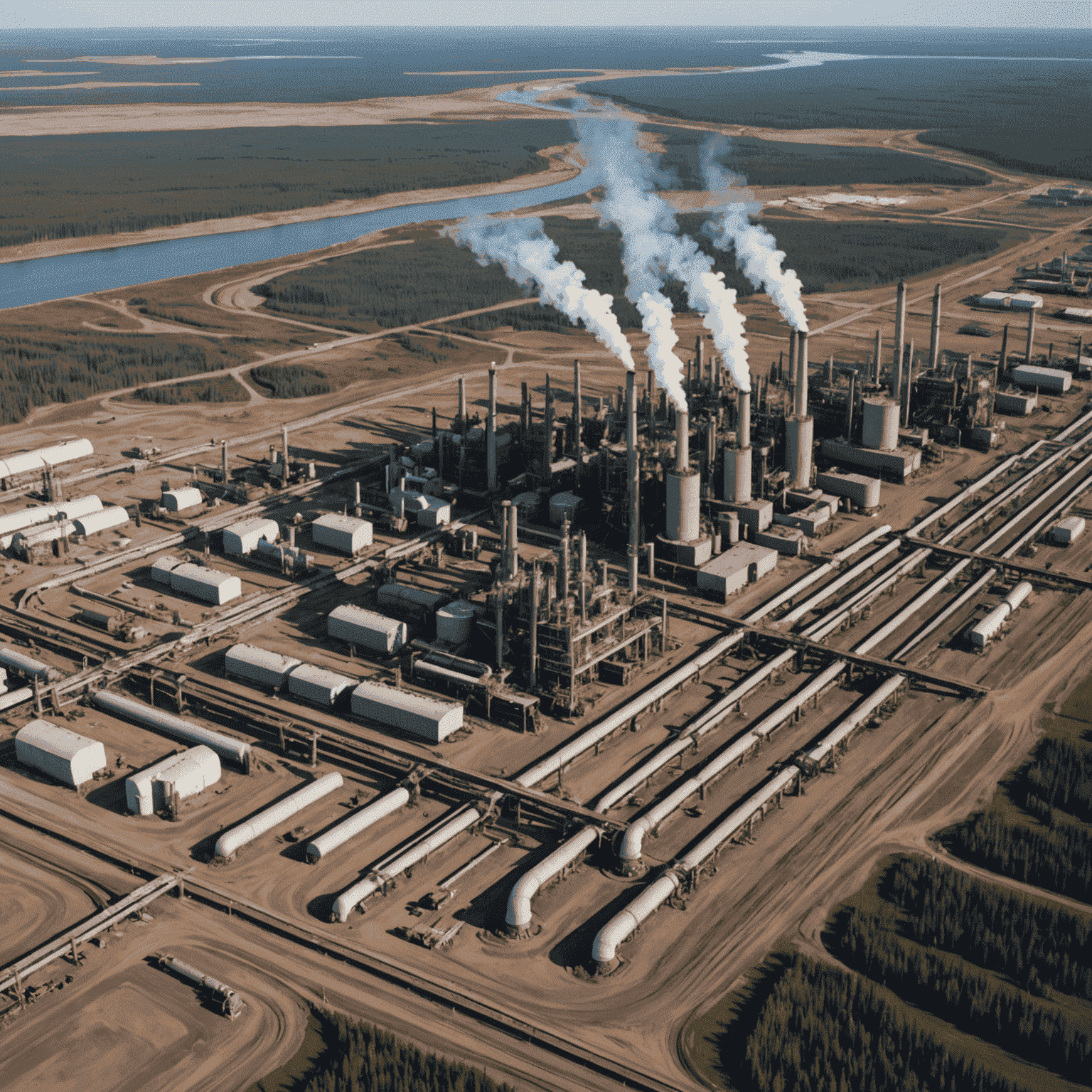

The Canadian Oil Landscape

Canada ranks as the fourth-largest oil producer globally, with the majority of its production centered in the oil sands of Alberta. The nation's vast reserves and stable political environment make it an attractive option for long-term investment and trading strategies.

Key Facts:

- Proven oil reserves: 168 billion barrels

- Daily production: Approximately 4.7 million barrels

- Major players: Suncor Energy, Canadian Natural Resources, Cenovus Energy

Global Market Impact

Canadian oil, particularly from the oil sands, has a significant influence on global oil prices and market dynamics. The unique properties of Canadian crude, such as its heavy composition, create both challenges and opportunities in the international market.

Factors Affecting Canadian Oil's Global Position:

- Transportation infrastructure and pipeline capacity

- Environmental regulations and sustainability concerns

- Technological advancements in extraction and refining

- Geopolitical tensions and trade relationships, especially with the United States

Opportunities for Traders

The Canadian oil industry presents various avenues for traders to establish a reliable income source. Here are some key strategies to consider:

- Futures Contracts: Engage in trading Canadian crude oil futures on exchanges like the Chicago Mercantile Exchange (CME).

- Energy Company Stocks: Invest in publicly traded Canadian oil companies, which often offer attractive dividends.

- Exchange-Traded Funds (ETFs): Explore ETFs that focus on the Canadian energy sector for diversified exposure.

- Options Trading: Utilize options strategies to capitalize on oil price volatility and hedge risks.

- Spread Trading: Take advantage of price differentials between Canadian crude and other global benchmarks.

Risks and Considerations

While the Canadian oil industry offers substantial opportunities, it's crucial to be aware of potential risks:

- Price volatility due to global economic factors and supply-demand dynamics

- Regulatory changes affecting production and transportation

- Environmental concerns and the push for renewable energy sources

- Currency exchange rate fluctuations between the Canadian dollar and other major currencies

Conclusion

The Canadian oil industry remains a cornerstone of the global energy market, offering traders a wealth of opportunities to create reliable income streams. By understanding the unique aspects of Canadian oil production, its global impact, and the various trading strategies available, investors can position themselves to capitalize on this resource-rich sector. As with any investment, thorough research, risk management, and staying informed about market trends are key to success in trading Canadian oil.