Risk Management in Oil Trading

In the volatile world of oil trading, effective risk management is crucial for protecting investments and ensuring sustainable profits. This article explores key strategies to mitigate risks and safeguard your trading activities in the ever-changing oil market.

Understanding Market Volatility

Oil prices are notoriously volatile, influenced by geopolitical events, supply and demand fluctuations, and economic indicators. Traders must stay informed about global trends and develop a keen understanding of market dynamics to anticipate potential risks.

Diversification Strategies

One of the most effective ways to manage risk is through diversification. This can include:

- Trading different types of oil (e.g., Brent, WTI, Dubai crude)

- Investing in oil-related products and derivatives

- Balancing long and short positions

- Exploring opportunities in renewable energy markets

Hedging Techniques

Hedging is a crucial risk management tool in oil trading. Common hedging strategies include:

- Futures contracts

- Options trading

- Swap agreements

- Cross-commodity hedging

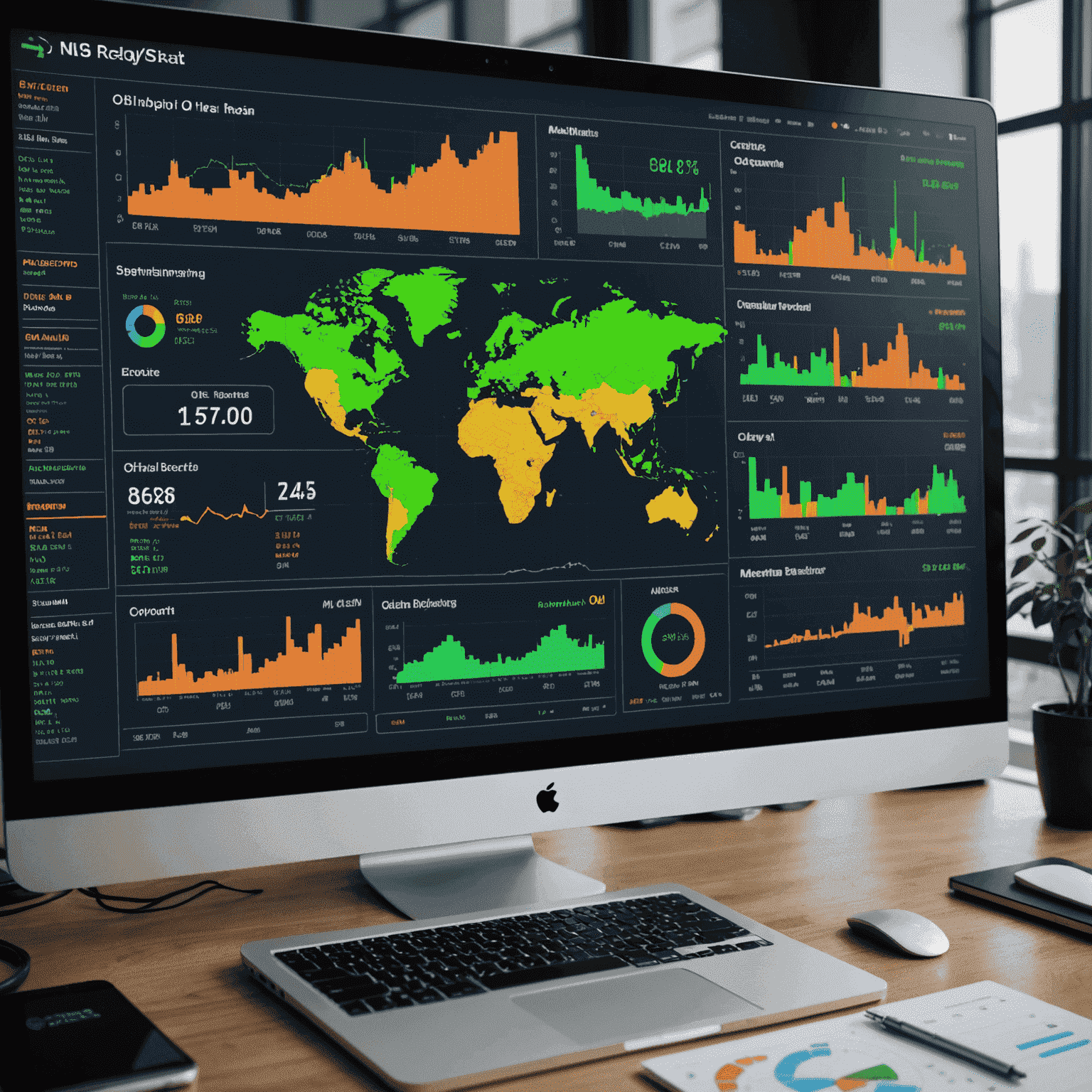

Advanced Analytics and Technology

Leveraging cutting-edge technology can significantly enhance risk management efforts:

- AI-powered market analysis tools

- Real-time data feeds and alerts

- Predictive modeling software

- Blockchain for secure and transparent transactions

Regulatory Compliance and Geopolitical Awareness

Staying compliant with international regulations and being aware of geopolitical risks is essential. Traders should:

- Keep up-to-date with changing regulations in different jurisdictions

- Monitor geopolitical tensions in oil-producing regions

- Understand the impact of sanctions and trade agreements on oil markets

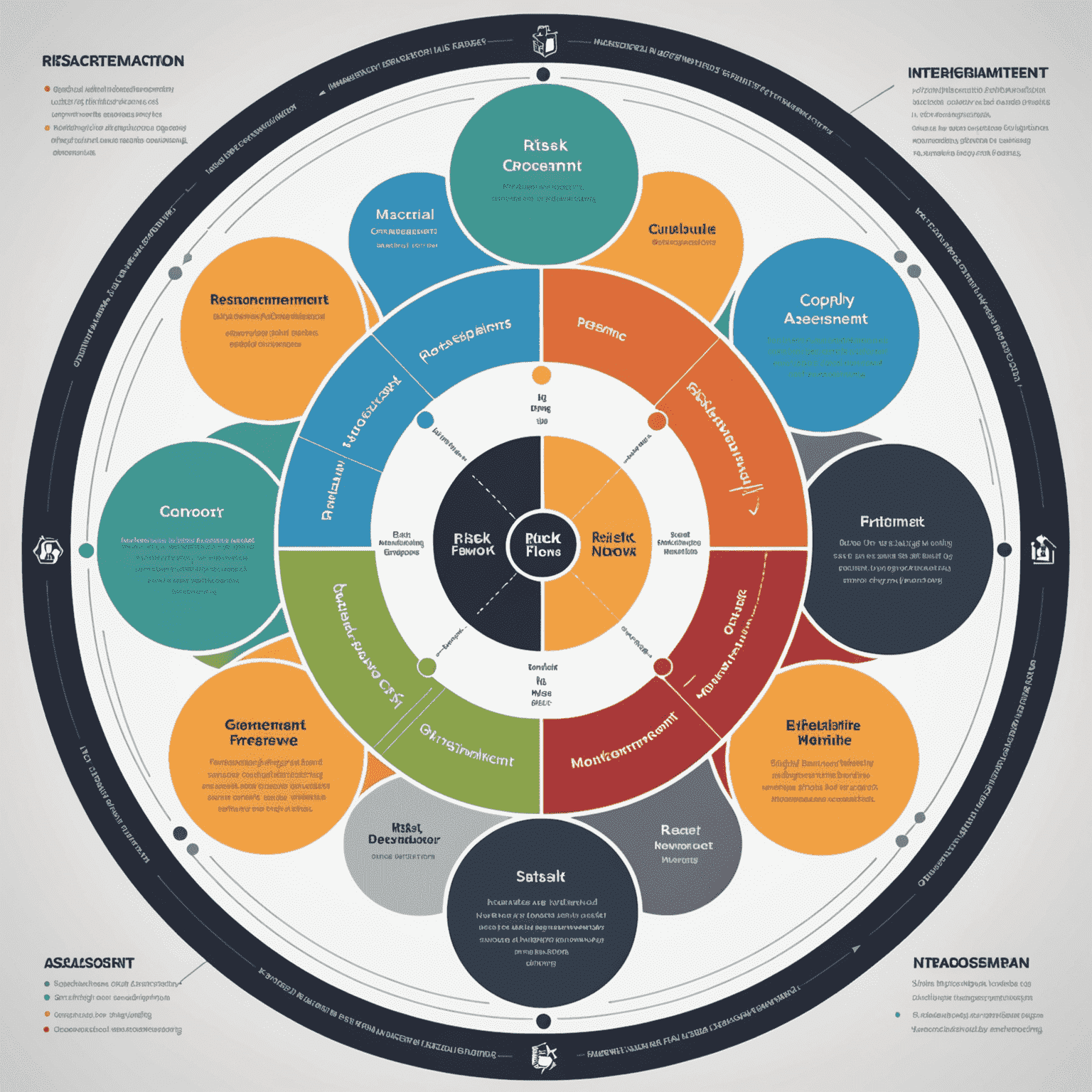

Building a Robust Risk Management Framework

Developing a comprehensive risk management framework involves:

- Setting clear risk tolerance levels

- Implementing stop-loss orders

- Regularly stress-testing trading strategies

- Maintaining adequate liquidity

- Continuous education and skill development

Conclusion

Effective risk management is the cornerstone of successful oil trading. By implementing these strategies and staying vigilant, traders can navigate the complexities of the oil market, protect their investments, and create a reliable income source through oil trading. Remember, the key to long-term success lies in balancing potential rewards with carefully calculated risks.